Required information

[The following information applies to the questions displayed below.]

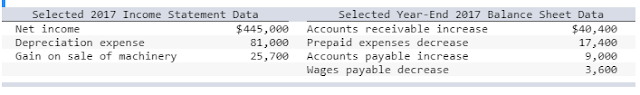

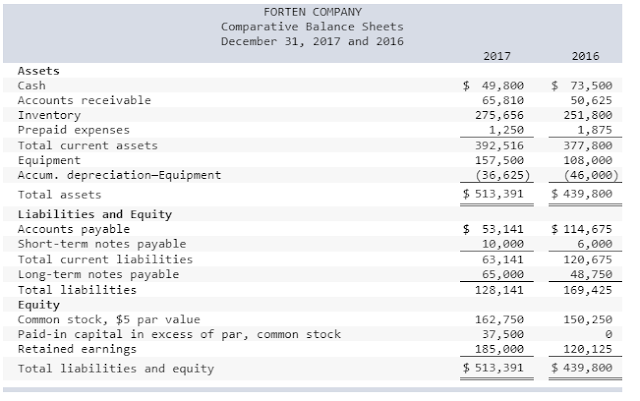

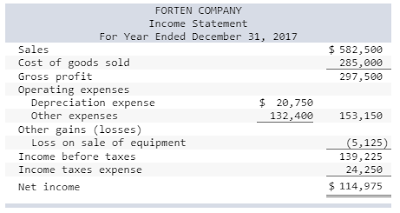

The following financial statements and additional information are reported.

Additional Information

- A $30,000 note payable is retired at its $30,000 carrying (book) value in exchange for cash.

- The only changes affecting retained earnings are net income and cash dividends paid.

- New equipment is acquired for $58,600 cash.

- Received cash for the sale of equipment that had cost $49,600, yielding a $2,100 gain.

- Prepaid Expenses and Wages Payable relate to Other Expenses on the income statement.

- All purchases and sales of inventory are on credit.

Required:

(1) Prepare a statement of cash flows for the year ended June 30, 2017, using the indirect method. (Amounts to be deducted should be indicated with a minus sign.)