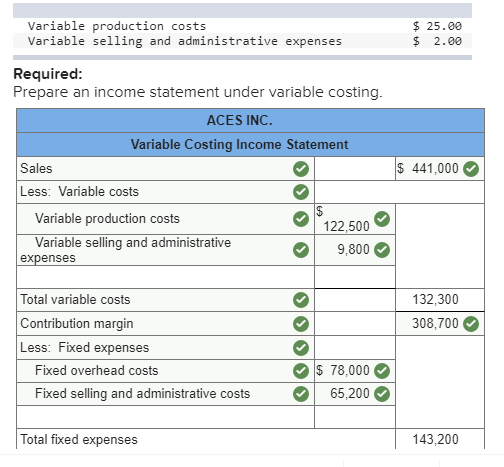

Aces Inc., a manufacturer of tennis rackets, began operations this year. The company produced 6,000 rackets and sold 4,900. Each racket was sold at a price of $90. Fixed overhead costs are $78,000, and fixed selling and administrative costs are $65,200. The company also reports the following per unit costs for the year:

Tuesday, February 27, 2018

Aces Inc., a Manufacturer of Tennis Rackets

Aces Inc., a manufacturer of tennis rackets, began operations this year. The company produced 6,000 rackets and sold 4,900. Each racket was sold at a price of $90. Fixed overhead costs are $78,000, and fixed selling and administrative costs are $65,200. The company also reports the following per unit costs for the year:

Vijay reports the following information regarding its production costs

Vijay reports the following information regarding its production costs. Compute its production cost per unit under absorption costing.

Compute its production cost per unit under variable costing.

Answer:

Per unit costs Absorption costing

Per unit costs Absorption costing

Direct material $10

Direct labor $20

Variable overhead $10

Fixed overhead $8

Total product cost per units $48

Answer:

Per unit costs

Direct material $10

Direct labor $20

Variable overhead $10

Fixed overhead -

Total product cost per units $40

US-Mobile Manufactures and Sells Two Products

US-Mobile manufactures and sells two products, tablet computers and smartphones, in the ratio of 5:3.Fixed costs are $105,000, and the contribution margin per composite unit is $125. What number of each type of product is sold at the break-even point?

Explanation:

Breakeven point in composite units = $105,000/$125 = 840 composite units

Number of products sold at breakeven = 8 × 840 = 6,720 units

Number of tablet computers sold at breakeven: 840 × 5 = 4,200 tablets

Number of smartphones sold at breakeven: 840 × 3 = 2,520 phones

Subscribe to:

Posts (Atom)