Alternative 1: Keep the old machine and have it overhauled. If the old machine is overhauled, it will be kept for another five years and then sold for its salvage value.

Thursday, March 22, 2018

Chapter 24 Computing net present value of alternate investments

Interstate Manufacturing is considering either replacing one of its old machines with a new machine or having the old machine overhauled. Information about the two alternatives follows. Management requires a 10% rate of return on its investments. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.)

Alternative 1: Keep the old machine and have it overhauled. If the old machine is overhauled, it will be kept for another five years and then sold for its salvage value.

Alternative 2: Sell the old machine and buy a new one. The new machine is more efficient and will yield substantial operating cost savings with more product being produced and sold.

Alternative 1: Keep the old machine and have it overhauled. If the old machine is overhauled, it will be kept for another five years and then sold for its salvage value.

Chapter 24 Analysis and computation of payback period, accounting rate of return, net present value

Most Company has an opportunity to invest in one of two new projects. Project Y requires a $350,000 investment for new machinery with a four-year life and no salvage value. Project Z requires a $350,000 investment for new machinery with a three-year life and no salvage value. The two projects yield the following predicted annual results. The company uses straight-line depreciation, and cash flows occur evenly throughout each year. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.)

1. Compute each project’s annual expected net cash flows.

2. Determine each project’s payback period.

3. Compute each project’s accounting rate of return.

Annual average investment= (cost+ salvage)/2

4. Determine each project’s net present value using 8% as the discount rate. Assume that cash flows occur at each year-end. (Round your intermediate calculations.)

Wednesday, March 21, 2018

Chapter 24 Computation of payback period, accounting rate of return, and net present value

Factor Company is planning to add a new product to its line. To manufacture this product, the company needs to buy a new machine at a $480,000 cost with an expected four-year life and a $20,000 salvage value. All sales are for cash, and all costs are out-of-pocket, except for depreciation on the new machine. Additional information includes the following. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.)

Required:

1. Compute straight-line depreciation for each year of this new machine’s life.

480000 - 20,000/4 = 115,000

2. Determine expected net income and net cash flow for each year of this machine’s life.

3. Compute this machine’s payback period, assuming that cash flows occur evenly throughout each year.

4. Compute this machine’s accounting rate of return, assuming that income is earned evenly throughout each year.

5. Compute the net present value for this machine using a discount rate of 7% and assuming that cash flows occur at each year-end. (Hint: Salvage value is a cash inflow at the end of the asset’s life.)

Required:

1. Compute straight-line depreciation for each year of this new machine’s life.

480000 - 20,000/4 = 115,000

2. Determine expected net income and net cash flow for each year of this machine’s life.

3. Compute this machine’s payback period, assuming that cash flows occur evenly throughout each year.

4. Compute this machine’s accounting rate of return, assuming that income is earned evenly throughout each year.

5. Compute the net present value for this machine using a discount rate of 7% and assuming that cash flows occur at each year-end. (Hint: Salvage value is a cash inflow at the end of the asset’s life.)

Monday, March 19, 2018

Chapter 24 Internal Rate of Retun

Park Co. is considering an investment that requires immediate payment of $27,000 and provides expected cash inflows of $9,000 annually for four years. Park Co. requires a 10% return on its investments.

1-a. What is the internal rate of return? (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round your present value factor to 4 decimals.)

1-b. Based on its internal rate of return, should Park Co. make the investment? Yes

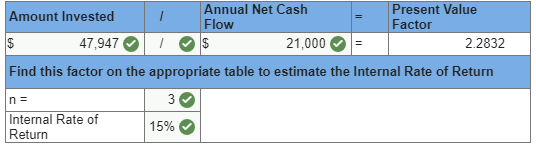

A company is considering investing in a new machine that requires a cash payment of $47,947 today. The machine will generate annual cash flows of $21,000 for the next three years.

What is the internal rate of return if the company buys this machine? (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.)

Explanation:

Present value factor =Amount invested/Net cash flows

=$47,947/21,000=2.2832

Searching the three year row in Table B.3 for a present value factor of 2.2832 shows that the internal rate of return is 15%

Chapter 24 Net Present Value

Peng Company is considering an investment expected to generate an average net income after taxes of $1,950 for three years. The investment costs $45,000 and has an estimated $6,000 salvage value. Assume Peng requires a 15% return on its investments. Compute the net present value of this investment. Assume the company uses straight-line depreciation. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Negative amounts should be indicated by a minus sign. Round your present value factor to 4 decimals.)

If Quail Company invests $50,000 today, it can expect to receive $10,000 at the end of each year for the next seven years, plus an extra $6,000 at the end of the seventh year. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round your present value factor to 4 decimals.)

What is the net present value of this investment assuming a required 10% return on investments?

Compute this investment’s net present value. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round all present value factors to 4 decimal places.)

Park Co. is considering an investment that requires immediate payment of $27,000 and provides expected cash inflows of $9,000 annually for four years. Park Co. requires a 10% return on its investments.

1-a. What is the net present value of this investment? (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round your present value factor to 4 decimals.)

1-b. Based on NPV alone, should Park Co. invest? Yes

If Quail Company invests $50,000 today, it can expect to receive $10,000 at the end of each year for the next seven years, plus an extra $6,000 at the end of the seventh year. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round your present value factor to 4 decimals.)

What is the net present value of this investment assuming a required 10% return on investments?

Following is information on an investment considered by Hudson Co. The investment has zero salvage value. The company requires a 12% return from its investments.

Park Co. is considering an investment that requires immediate payment of $27,000 and provides expected cash inflows of $9,000 annually for four years. Park Co. requires a 10% return on its investments.

1-a. What is the net present value of this investment? (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round your present value factor to 4 decimals.)

1-b. Based on NPV alone, should Park Co. invest? Yes

Explanation:

*Present value factor from Table PVA of $1:

3.1699 = Present value of an annuity of 1, wheren= 4,i= 10%

Sunday, March 11, 2018

Chapter 18: Break-even Points, Contribution Margin Income Statement

Required:

1. Compute the break-even point in dollar sales for year 2017.

Explanation:

Calculation of contribution margin ratio 20%

Sales price per unit ($100,000 / 20,000) $ 50.00

Variable costs per unit ($800,000 / 20,000) $ 40.00

Contribution margin ratio (50.00 – $40.00) / $50.00) 20 %

Explanation:

| Fixed costs | ||

| break-even point in dollars | = | |

| Contribution margin ratio |

| 2016 break-even in sales dollars | = | Fixed costs / Contribution margin ratio |

| = | $450,000* / 60%** | |

| = | $750,000 |

| *To compute predicted fixed costs |

| 2015 fixed costs plus 2016 increase ($250,000 + $ 200,000) = $450,000 |

| **To compute predicted contribution margin ratio |

| Predicted sales price per unit (no change in sales price) | $ | 50.00 | ||

| Predicted variable costs per unit (($800,000 × 50%) / 20,000) | $ | 20.00 | ||

| Predicted contribution margin ratio ($50.00 – $20.00) / $50.00) | 60 | % |

Explanation:

| Sales: 20,000 × $50.00 = $100,000 |

| Variable costs: 20,000 × $20.00 = $400,000 |

| Contribution margin: 20,000 × $30.00 = $600,000 |

4. Compute the sales level required in both dollars and units to earn $200,000 of target pretax income in 2018 with the machine installed and no change in unit sales price.

Explanation:

| Fixed costs + Target pretax income | ||

| Required sales in dollars | = | |

| Contribution margin ratio |

| Required sales in dollars | = | ($450,000* + $200,000) / 60%*** |

| = | $650,000 / 60% | |

| = | $1,083,333 |

| Fixed costs + Target pretax income | ||

| Required sales in units | = | |

| Contribution margin per unit |

| Required sales in units | = | ($450,0000 + $200,000) / $30.00 |

| = | 21,666 units (rounded up to whole units) |

| * 2015 fixed costs plus 2016 increase ($450,000 + $200,000) | $ | 650,000 |

| ***Predicted contribution margin ratio ($50.00 – $20.00) / $50.00)— from Part 2 | 60% |

5. Prepare a forecasted contribution margin income statement that shows the results at the sales level computed in part 4. Assume no income taxes will be due. (Round your intermediate calculation and final answer to the nearest whole dollar.)

Explanation:

Sales: 21,666 units × $50.00 = $1,083,333

Variable costs: 21,667 units × $20= $433,333

Contribution margin: 31,938 units × $20.90 = $667,504

Income before income taxes is slightly greater than the targeted $250,000 income due to rounding of units.

Sales: 21,666 units × $50.00 = $1,083,333

Variable costs: 21,667 units × $20= $433,333

Contribution margin: 31,938 units × $20.90 = $667,504

Income before income taxes is slightly greater than the targeted $250,000 income due to rounding of units.

Subscribe to:

Comments (Atom)