Park Co. is considering an investment that requires immediate payment of $27,000 and provides expected cash inflows of $9,000 annually for four years. Park Co. requires a 10% return on its investments.

1-a. What is the internal rate of return? (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round your present value factor to 4 decimals.)

1-b. Based on its internal rate of return, should Park Co. make the investment? Yes

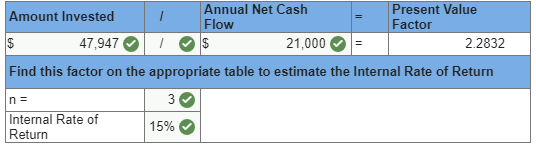

A company is considering investing in a new machine that requires a cash payment of $47,947 today. The machine will generate annual cash flows of $21,000 for the next three years.

What is the internal rate of return if the company buys this machine? (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.)

Explanation:

Present value factor =Amount invested/Net cash flows

=$47,947/21,000=2.2832

Searching the three year row in Table B.3 for a present value factor of 2.2832 shows that the internal rate of return is 15%

No comments:

Post a Comment